| |

| Long title | An act to amend the Internal Revenue Code of 1954 to encourage economic growth through reduction of the tax rates for individual taxpayers, acceleration of the capital cost recovery of investment in plant, equipment, and real property, and incentives for savings, and for other purposes. |

|---|---|

| Acronyms (colloquial) | ERTA |

| Nicknames | Kemp–Roth Tax Cut |

| Enacted by | the 97th United States Congress |

| Effective | August 13, 1981 |

| Citations | |

| Public law | 97-34 |

| Statutes at Large | 95 Stat. 172 |

| Legislative history | |

| |

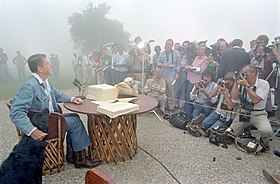

The Economic Recovery Tax Act of 1981 (ERTA), or Kemp–Roth Tax Cut, was an Act that introduced a major tax cut, which was designed to encourage economic growth. The Act was enacted by the 97th US Congress and signed into law by US President Ronald Reagan. The Accelerated Cost Recovery System (ACRS)[1] was a major component of the Act and was amended in 1986 to become the Modified Accelerated Cost Recovery System (MACRS).[2]

Representative Jack Kemp and Senator William Roth, both Republicans, had nearly won passage of a tax cut during the Carter presidency, but President Jimmy Carter feared an increase in the deficit and so prevented the bill's passage. Reagan made a major tax cut his top priority once he had taken office. The Democrats maintained a majority in the US House of Representatives during the 97th Congress, but Reagan convinced conservative Democrats like Phil Gramm to support the bill. The Act passed the US Congress on August 4, 1981, and it was signed into law by Reagan on August 13, 1981. It was one of the largest tax cuts in US history,[3] and ERTA and the Tax Reform Act of 1986 are known together as the Reagan tax cuts.[4] Along with spending cuts, Reagan's tax cuts were the centerpiece of what some contemporaries described as the conservative "Reagan Revolution."

Included in the act was an across-the-board decrease in the rates of federal income tax. The highest marginal tax rate fell from 70% to 50%, the lowest marginal rate from 14% to 11%. To prevent future bracket creep, the new tax rates were indexed for inflation. Also reduced were estate taxes, capital gains taxes, and corporate taxes.

Critics of the act claim that it worsened federal budget deficits, but supporters credit it for bolstering the economy during the 1980s. Supply-siders argued that the tax cuts would increase tax revenues. However, tax revenues declined relative to a baseline without the cuts because of the tax cuts, and the fiscal deficit ballooned during the Reagan presidency.[5][6][7][8][9][10][11]

Much of the 1981 Act was reversed in September 1982 by the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA), which is sometimes called the largest tax increase of the postwar period.

- ^ Steve Lohr (February 21, 1981). "Depreciation's effect on taxes". The New York Times.

- ^ "Depreciation and Amortization tax form)" (PDF). The New York Times.

- ^ Petulla, Sam; Yellin, Tal (January 30, 2018). "The biggest tax cut in history? Not quite". CNN. Retrieved April 6, 2019.

- ^ Kessler, Glenn (April 10, 2015). "Rand Paul's claim that Reagan's tax cuts produced 'more revenue' and 'tens of millions of jobs'". Washington Post. Retrieved October 16, 2015.

- ^ "Can countries lower taxes and raise revenues?". The Economist. ISSN 0013-0613. Retrieved 2020-06-13.

- ^ "How the GOP tax overhaul compares to the Reagan-era tax bills". PBS NewsHour. 2017-12-04. Retrieved 2020-06-13.

- ^ Chait, J. (2007). The Big Con: How Washington Got Hoodwinked and Hijacked by Crackpot Economics. Boston: Houghton Mifflin. ISBN 978-0-618-68540-0.

- ^ "Rand Paul's claim that Reagan's tax cuts produced 'more revenue' and 'tens of millions of jobs'". The Washington Post. 2015.

A Treasury Department study on the impact of tax bills since 1940, first released in 2006 and later updated, found that the 1981 tax cut reduced revenues by $208 billion in its first four years. (These figures are rendered in constant 2012 dollars.)

- ^ "How Reagan's Tax Cuts Fared". NPR.org. Retrieved 2020-06-14.

- ^ Treasury Department (September 2006) [2003]. "Revenue Effects of Major Tax Bills" (PDF). United States Department of the Treasury. Working Paper 81, Table 2. Retrieved 2007-11-28.

- ^ "History lesson: Do big tax cuts pay for themselves?". The Washington Post. 2017.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search